Chapter 3

Business Feasibility

- Introduction

- Measures of Business Success

- About You

- About Your Business

- Start-up Costs

- Exploration

- Chapter Review

Introduction

Just because you have a great business idea does not mean it will become a successful business. You need to figure out if your idea is actually possible. To figure out business feasibility, or the chance that your business will succeed, you look at things like:

- The people who would want to buy your product or service

- The details of running your business

- How much money you will need to get started

- How much money you might make once you start selling your product or service

As part of this chapter, there are several worksheets you can complete to help you evaluate business feasibility. Your answers will help you develop a business plan later.

To get started, read the information in the Measures of Business Success tab and learn how to do a quick cost evaluation exercise. The exercise will help you figure out if you want to continue exploring business feasibility in more detail.

Measures of Business Success

There are three important parts to business success:

- Customers

- Management and operations

- Financing

Business Success Measures

Customers

Businesses need customers to survive. You need to think about:

- Why people would be interested in buying your product or service

- How to reach potential customers with advertising and marketing

Management and Operations

There are many important tasks you must do to run a business. These tasks can include:

- Keeping records (for example, tracking repeat customers or shipping dates)

- Bookkeeping (tracking financial information like sales and expenses)

- Preparing reports

- Filing taxes

- Purchasing supplies and equipment

- Advertising

- Communicating with customers and suppliers

You need to know how these tasks will be done and who will do them. Will it be you? A volunteer? A friend or family member? Or someone you hire, such as an accountant?

Financing

Every business needs money to get up and running. You need to figure out what things you need to start and run your business, and how much everything costs.

Start-up financing can be broken into three parts:

- Personal living expenses - money to cover your living costs until the business can pay you wages and earn a profit.

- Start-up costs - money for things you need before your business opens. Examples are equipment, supplies, and business licenses.

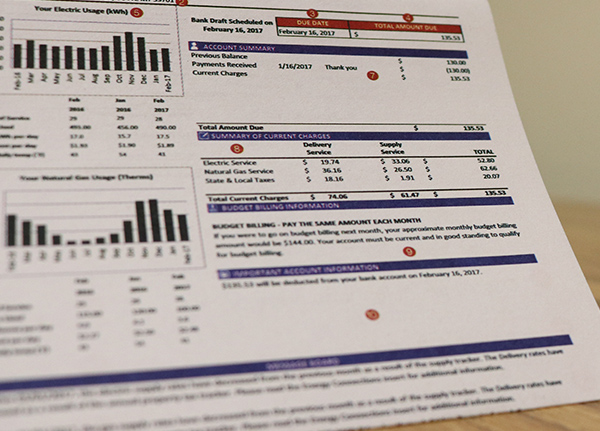

- Fixed operating costs - things you have to pay for every month even if you are not making any money or selling any product. These are things like rent, utility bills, insurance, and advertising.

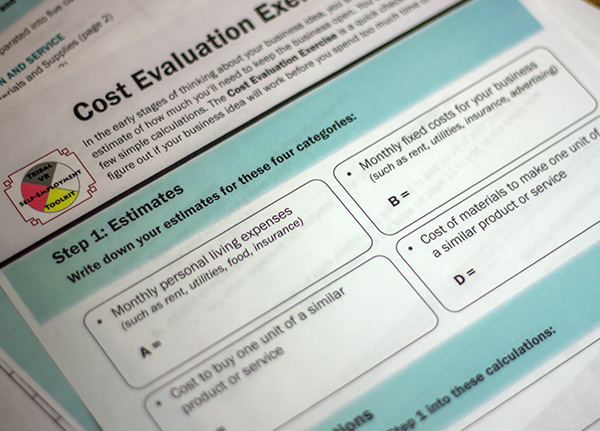

Cost Evaluation Exercise

In the early stages of thinking about your business idea, you should make a rough estimate of how much product or service you’ll need to sell to keep the business open. You can do this with a few simple calculations.

The cost evaluation exercise is a quick check to see if your business idea will work before you spend too much time on planning. You can do this exercise on your own or with your TVR counselor. You will do a more detailed version of this exercise in the Chapter 7: Financial Plan if you go on to develop a full business plan. Download the Cost Evaluation Worksheet.

Estimates

Write down your estimates for these four categories:

- A = Your monthly living expenses (such as rent, utilities, food, insurance)

- B = Monthly fixed costs for your business (such as rent, utilities, insurance, and advertising)

- C = Cost to buy one unit of a similar product or service

- D = Cost of materials to make one unit of a similar product or service

Calculations

Plug your estimates into these calculations:

- A + B = Monthly expenses

- C - D = Gross profit per unit sales

Next, use monthly expenses (A + B) and gross profit per unit sales (C-D) estimates to figure out how many units of a product or service you need to sell each month.

- Monthly expenses ÷ gross profit per unit = how many units you need to sell

Thumbs Up or Thumbs Down?

Now that you have figured out how many units you’ll need to sell each month to cover your total monthly expenses, think about these questions:

- How long will it take you to make and sell this many units each month?

- Does this seem possible?

- Do you want to work this hard?

- Can you work this much with your disability?

If you answered “no” to any of these questions, talk your business idea over with your TVR counselor.

- Do you want to change your business idea to make it more feasible?

- Are there accommodations that could help?

- Would getting a job working for an established business be a better plan?

Cost Evaluation Example: Lucy’s Traditional Sewing

Lucy’s Traditional Sewing

Lucy wants to start a business making ribbon shirts. She made these estimates to see if her idea would work.

-

Monthly living expenses

- $600 rent + $400 food + $200 insurance + $200 utilities = $1400

- A = $1400

-

Estimate of monthly fixed costs to operate the business

- Although Lucy is running a home-based business, she still estimates $50 advertising, $100 phone, and $50 for incidentals = $200

- B = $200

-

Cost to buy one unit of a similar product or service

- C = $100 per shirt

-

Cost of materials to make one unit of similar product or service

- D = $25 per shirt

Lucy’s Calculations

Lucy did the following calculations:

- A + B = $1,400 living expenses + $200 monthly fixed costs = $1,600 monthly expenses

- C – D = $100 sales price per shirt - $25 costs of materials per shirt = $75 gross profit per shirt

- Monthly expenses ÷ gross profit = $1600 ÷ $75 = 21 shirts

Thumbs up! Lucy decided that making and selling 21 shirts each month seemed possible. By working from her home, she can rest when she needs to, which she is not able to do at her current job. She knows that this is just a rough estimate to decide if she wants to continue with the business feasibility process.

Cost Evaluation Example: Len’s Lawn Care

Len’s Lawn Care

Len wants to start a lawn care business. He made these estimates to see if his idea would work.

-

Monthly living expenses

- $800 rent + $500 food + $200 insurance + $200 utilities = $1700

- A = $1700

-

Estimate of monthly fixed costs to operate the business

- Len already owns a lawn mower and some lawn care tools, but he estimates $50 advertising, $100 phone, and $50 for incidentals = $200

- B = $200

-

Cost to buy one unit of a similar product or service

- C = $90 per account (estimated at 3 lawn mows per month)

-

Cost of materials to make one unit of similar product or service

- D = $10 per account

Len’s Calculations

Len did the following calculations

- A + B = $1,700 living expenses + $200 monthly fixed costs = $1,900 monthly expenses

- C – D = $90 sales price per lawn - $10 cost of materials per lawn = $80 gross profit per account

- Monthly expenses ÷ gross profit = $1900 ÷ $80 = about 24 accounts

Thumbs down. Len decided that caring for 24 accounts (and mowing close to 75 lawns) each month was not possible. He realized that caring for so many lawns would mean he would not have time to fulfill his family duties. He also thought it would be hard to line up that many accounts in his small community. He decided to look for a landscaping job working for someone else in a nearby town.

Use the "Return to Tabs" button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

About You

Running a successful business requires many different skills and traits. Thinking about your business goals and skills will help you figure out if self-employment is a good fit at this time.

Download, save, and fill in the About You Worksheet. The section below follows along with the worksheet and helps you describe your skills as a business owner. Some of this information builds on the self-assessments covered in Chapter 2: Self-Employment Readiness.

See David’s Traditional Drums About You Worksheet to see a filled-out example.

About You Worksheet Questions

Why Self-Employment?

Why do you want to be self-employed? (see Chapter 2: Readiness).

There are many reasons why people want to be self-employed. Here are some examples:

- Needing flexible work hours

- Limited job opportunities in the area

- Demand or need for your product or skills

- Workplace attitudes that prevent you from working at your full potential

Your Business Idea

How did you come up with your business idea?

Business ideas are likely to be more successful if they are based on:

-

Experience

- Having been in the same or a similar business for a number of years

- Having the skills to deliver your product or service

-

Interest

- Passion for the product or service

- Willingness to take time to learn about the product or service

-

Demand

- Customers wanting or needing your product or service

Your Experience

What previous experience or training has prepared you to run this business?

- In what ways does this experience apply to making your product or delivering your service?

-

How might this experience contribute to other aspects of business success?

-

For example, do you have experience with things like:

- Bookkeeping

- Ordering supplies

- Customer service

- Advertising or marketing

- Other skills needed to run your business

-

For example, do you have experience with things like:

Past Self-Employment

Have you ever owned a business? If yes,

-

What did the business do?

- How does the product or service of your previous business relate to your proposed business?

- How long was the business open?

- Why did you close the business?

- In what ways was the business successful?

- What will you do the same or different in your proposed business?

Disability Accommodations

Some people need accommodations to run their business. Examples are things like:

- Flexible work hours or part-time work

- Breaks throughout the day

- Limited pressure or stress

- Limited walking, standing, reaching, or lifting

- Need for specially-designed equipment or assistive technology

- Personal assistance with some parts of business operations

Are there any accommodations you need? How will you set up your business to accommodate your disability? Think about things like business location, office equipment, office set-up, and ways of communicating with customers.

Skills and Knowledge

Do you need to gain more knowledge to run your business?

Would improving your skills, or learning more about your product or service, help you?

Do you need any formal education or credentials, such as a professional license, certification, or degree to operate your business?

-

What educational degree or credentials do you need?

- What are your plans to get them? When do you think you will have them?

- If you need an educational degree, how can business management knowledge be included in the degree?

- Does your proposed business require an apprenticeship? If so, what are your plans for finding one?

Training

Do you need any training to run your business?

-

If yes, what kind of training will you need?

- What are your plans for getting the training?

-

Is there a training program? If there is:

- Where and when is the training program?

- How much does it cost?

- Can the training be on-the-job?

- Are there other ways you can get needed training?

Bookkeeping

Every business needs a system to keep track of things like purchases, sales, and expenses.

-

How will you do your bookkeeping?

- Will it be with a notebook and a special file cabinet? Or will you use a computer with bookkeeping software?

- If needed, who will help you set up your system?

- If needed, who will help you maintain this system?

- How will you keep your personal and business expenses separate?

Business Activities

Keeping in mind that a typical full-time job is 40 hours per week, how many hours per week do you think you will have to spend on the following self-employment activities?

- Reaching out to potential customers through advertising and marketing activities

- Serving current customers

- Making products

- Maintaining financial records

- Purchasing supplies

- Planning and managing the business

- Traveling

- Other business activities

Check with another small business owner to see if your estimates are realistic and similar to theirs.

Use the "Return to Tabs" button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

About Your Business

This section asks questions about your business, including your potential customers, other similar businesses, and business location. Answering these questions requires a lot of work, but this is an important step in business planning. You don’t have to fill out all the questions right away, but you’ll need to answer them to reach the final stages of business planning.

Some questions may be hard to answer or confusing. You can always skip some questions and come back to them when you have learned more in later chapters or talked to others for advice.

This section follows the About Your Business Worksheet, which you can download and fill out.

See David’s Traditional Drums About Your Business Worksheet for a filled-out example.

The Basics

To get started putting together a business plan, you need to be able to describe your business and how it will be run day-to-day.

Business Name

What is the name of your business? (see Chapter 4: The Business Plan)

- Does this name describe your business?

-

Is the name available and unique?

- Is there another business with the same or a similar name nearby that might confuse customers?

Product or Service Description

What will your business do? (see Chapter 4: The Business Plan)

- Did you describe the main products or services you will provide?

-

Are there other services or products you could sell to increase your earnings?

- Think about other things your customers might want. For example, a hairdresser might sell haircare products, or a lawn mowing business might offer services like leaf raking or snow removal during different seasons.

Day-to-Day Operations

How will you run your business on a day-to-day basis? (See Chapter 6: The Operations Plan)

- How will you do things like manage money, provide receipts, order supplies, and make deliveries?

- Which tasks will you need to do every day? Which tasks will you need to do weekly?

- What accommodations or help will you need to do these things?

Business Structure

Every business has a business structure that determines how the business pays taxes and fulfills other legal responsibilities. The most common business structures are sole proprietorship, limited liability company, corporation, general partnership, and non-profit. Most TVR consumers choose sole proprietorship and limited liability company business structures because they are the easiest to set up.

It is important to get professional advice when picking a business structure, especially if you receive SSI or SSDI benefits.

What business structure will your business have? (see Chapter 4: The Business Plan)

- Why did you select this business structure?

- If you receive SSI or SSDI, how will this business structure affect your public assistance benefits?

Potential Customers

Every business needs customers. Learning about your potential customers helps you reach out to them and make sure your business has products or services they want.

Know Your Customers

Who are your potential customers? (see Chapter 5: The Marketing Plan)

- Where do they live?

- What is their range of income?

- Education level?

- Gender?

- Age range?

- What are some important interests they have?

If you plan to sell your product or service to other businesses, describe these businesses.

How did you figure out this information about your potential customers? Is this information reliable, or do you think you should get additional viewpoints?

Business Features

Why will customers want to buy your product or service? (see Chapter 5: The Marketing Plan)

- What want or need does your product or service fill?

- How did you figure out that there is a want or need for your product or service?

Marketing

How will you advertise or market your product or service to customers? (see Chapter 5: The Marketing Plan)

- What methods of marketing will you use (such as website, brochures, posters, newspaper advertisements, or social media)?

- How much will each marketing method cost?

- Will you use different strategies to reach different customers?

Other Businesses

It is helpful to learn more about businesses that are similar to yours when thinking about opening a new business. Learning what similar businesses do well can provide ideas for your own business. Figuring out how your business is different from other businesses can help you fine-tune your advertising to highlight what makes your business unique or special.

Similar Businesses

What businesses are similar to yours? (see Chapter 5: The Marketing Plan)

- Name a few businesses that offer the same or similar products or services.

- Describe what they do well.

- Describe what sets your business apart.

Business Traits

Why will people choose your business instead of other similar businesses? (see Chapter 5: The Marketing Plan)

- Does your business have special strengths?

- Are you providing something that your customers need?

- Explain how you determined this information.

Location

Description

What is your business location and address? (see Chapter 6: The Operations Plan)

- Is the location in a safe area?

- Does the location make sense for the type of business you plan to operate?

- If the business is in your home, what are the benefits and drawbacks of this as a business location?

Neighbors

What other kinds of businesses are near your location?

-

How will these businesses affect your business?

- Will these businesses attract customers that might also want to come to your business?

- Do these businesses pose any health or personal risks to you or your customers?

If you are running a business out of your home, how will this affect your neighbors?

-

Will business traffic to your home or noise from your business bother your neighbors?

- What are your plans for addressing this?

- How will your neighbors affect your business?

Customers

How will customers find and get to your business?

- How will you advertise your location?

- Is there parking nearby?

- Can people walk to your business?

- Will customers be able to access your location year-round? Are there seasonal transportation issues in your area?

Some of these questions may not apply for a home-based or online business.

Necessary Approvals

What kinds of approvals do you need before you start your business? (see Chapter 6: The Operations Plan)

- Do you need tribal council approval before you start your business in this location?

- Do you need a business license?

- Are there zoning laws or other restrictions for your business location?

If you answered 'yes' to any of these, how will you go about getting the approvals you need?

Feasibility

Challenges to Business Start-up

Even if you have a good business idea, there may be challenges to starting your business, such as:

- Restrictions, patents, or copyrights

- Challenges in getting materials or supplies

- Negative environmental impacts of the business

- Concerns about how to advertise or market the business

- Concerns about paying off existing debt

- Poor credit scores that could make it difficult to get financing

- Restrictions on use of tribal land

- Restrictions based on TVR policies and procedures

- Other challenges

Action

Do any challenges apply to you? If yes, discuss them with your counselor or a business development expert to get ideas for addressing them.

Take time to record any additional thoughts about your business that may be important for future planning.

Use the "Return to Tabs" button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Start-up Costs

If you and your TVR counselor decide your business idea is feasible, the next step is figuring out how much money you need to get your business up and running. This section helps you estimate your start-up and operating costs for the first month.

Download, save, and use the Start-up Cost Estimates Worksheet as you go through this section.

This worksheet will help you think about all the different things that you have to pay for as you get your business up and running.

See David’s Traditional Drums Start-Up Cost Estimates Worksheet for a filled-out example.

Start-Up Cost Estimates

There are some common expenses to think about when you estimate start-up costs. Depending on what type of business you are starting, you might not have costs to fill out in each section.

Start-up costs can be separated into five broad categories:

1. Production and Service (pgs. 2-5 in the Start-Up Costs worksheet)

- Materials and supplies

- Inventory

- Equipment

- General supplies

2. Physical Space (pgs. 6-9 in the Start-Up Costs worksheet)

- Furniture, displays, shelving

- Remodeling

- Rent or mortgage payments

- Utilities

3. Advertising (pg. 9 in the Start-Up Costs worksheet)

- Advertising and marketing

- Signs

4. Business Management (pgs. 10-11 in the Start-Up Costs worksheet)

- Business licenses, registrations, and permits

- Legal and accounting fees

- Insurance

5. Other Expenses (pg. 12 in the Start-Up Costs worksheet)

- Any other expenses not included in the other categories

Production and Service

Production and service costs focus on things you need to deliver your product or service. These include materials and supplies, inventory, equipment, and general supplies.

Materials and Supplies

If you are making a product, or providing a service, list all materials and supplies you need to make or deliver your first two months of goods or services. You estimate two months of materials and supplies because you often need to produce your first month’s inventory before the first month of business operation.

Materials and supplies are often things you use up when you make your product or provide your service. Refer back to the Cost Evaluation Exercise you did in Chapter 2 to see how many units of your product you need to make each month so you have a better idea of how much of each material or supply you need.

For instance, if you are planning to sell jewelry, what beads, silver, wire, and clasps do you need?

Inventory

If you are starting a business that sells things you do not make yourself, list inventory you need on hand to open and run the business for the first month.

For instance, if you are starting a rock shop, what minerals or rocks do you need to purchase for customers to buy.

Equipment

List each piece of equipment you need to purchase for your business. Equipment includes things you need to run your business that have a useful life of one year or longer. They can be bigger items, like a rototiller, or more expensive items, like camera equipment or a computer. Depending on what it is, you can lease or purchase the equipment you need.

For instance, a t-shirt business might need to purchase a t-shirt printer or heavy-duty heat-press.

General Supplies

List any general supplies you need to purchase for your business. General supplies are things that you need to run your business, but are not covered in the materials and supplies, inventory, or equipment categories. These can include things like cleaning supplies, office supplies such as pens and tape, or small tools.

For instance, if you are a jewelry maker for an online business, you might need some tools such as needle-nose pliers and packing materials to mail your product to customers.

Physical Space

Physical space costs focus on your business space. These costs include one-time-only costs to get the business location ready for the public (such as set-up and remodeling costs) and monthly costs to maintain the space (such as rent and utilities).

Fixtures, Furniture, Displays, and Shelving

List any fixtures, furniture, displays, or shelving you need to purchase for your business.

For example, you might need shelving to display your products, or an office chair and desk.

Remodeling

List any costs for remodeling activities, such as replacing windows, repainting, or installing railings or ramps.

Rent or Mortgage Payments

If you are renting your business space, list out how much it costs per month. If there is a deposit, include that. If you don’t rent but have a monthly mortgage payment to purchase the space, put down that cost.

For instance, you may have to pay first and last month’s rent plus a security deposit in order to rent the space for the first month.

Utilities

List start-up fees and utility costs for the first month. These might include phone, electricity, water, internet, and garbage. If you are running the business out of your home, some of these costs may not apply or should be split between personal and business expenses.

Advertising

Advertising costs focus on your grand opening marketing efforts and signage for the business. Initial costs can include costs related to developing a logo, printing business cards, and developing a website.

Advertising and Marketing

List costs for any advertising or marketing you will do for your business opening. (Other ongoing advertising and marketing will be included in your full Marketing Plan, which is covered in Chapter 5).

For example, you might develop a website, buy ads in the local newspaper about your grand opening, or print flyers to hand out at a powwow or high school sporting event.

Signs – outside and inside

List costs for signs inside and outside your business location. Think about where you will put signs, how many you will need, and what size they should be.

Business Management

Business management costs focus on legal requirements for running a business. These include costs for required licenses and permits, fees related to setting up your business structure and accounting systems, and insurance, to make sure your business and assets are covered.

Business Licenses, Registrations, Permits

List any business licenses, registrations, or permits needed to operate your business.

For example, a food truck might need a local business license, a health department permit, and a food handler’s permit.

Legal and Accounting Fees

List any legal or accounting fees for your business start-up activities. These might include costs for an accountant to help you set up a bookkeeping system, or payment to a lawyer to consult about your business structure.

Insurance

List 6-month premium costs for each type of insurance you need for your business. If you need any separate policies, list those.

For instance, if your business is based out of your home, your homeowner’s policy may require a rider for business activities. Other typical insurances include extra insurance for business vehicles, equipment, or supplies stored in an off-site location.

Other Expenses

Do you have any other expenses that don’t fit into one of the previous categories? List them in the other category.

Total Costs and Funding Sources

Once you fill out the Start-Up Cost Estimates worksheet, you will have a good idea of how much money you will need to start your business. Next, you need to figure out how to cover all these costs. You might cover these costs with resources you currently have, funds you may be eligible for, such as from the TVR program, and loans from other sources like banks or family and friends.

Cash on Hand

Cash on hand, also called cash reserve, is the money you have right now that you can use to pay bills until your business starts making money. Cash reserve can come from your personal savings, loans, or from other sources like your family, friends, or grants. (This information will be covered more in Chapter 7: The Financial Plan).

Do you have enough cash reserve to pay your bills during start-up? To help you think about this, you may want to fill out a cash flow statement. A cash flow statement is a useful tool to help you figure out how much money you’ll need each month, and if you might run out of money in the short-term (see Chapter 7: The Financial Plan).

Donated Items

Donated items (also called in-kind contributions) are things you already have to use for your business and don’t need to buy. These things could be donated by you, or by someone else. List each item with an estimated “as is” value. These items may count towards your business assets, which can be used as collateral to get a business loan.

For example, maybe you already own an accessible van or a computer that you can use for your business.

Other Sources of Cash

Costs that aren’t covered by your cash reserve or donated items will need to be covered by other funds. Talk to your TVR counselor, small business development advisor, or business mentor about other possible sources of funding. There are also funding resources listed in the Resources section (which can be accessed from the navigation bar going across the very top of this website).

Use the "Return to Tabs" button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Exploration

There are many ways to get a better idea of how it will actually feel to own and run a business. In this section, you will learn about some of these options. Your TVR program may be able to help you set up some of these business exploration opportunities. If they cannot, you might be able to reach out to family, friends, or other community members to help you.

Exploration Strategies

Before you spend money and resources to start your business, take time to learn about what it really means to be self-employed. Talk to other business owners. Ask how they got started. Learn about the challenges and downsides of self-employment as well as the benefits.

Get information from as many different people as you can.

- Talk to business owners with and without disabilities

- Talk to people who have started businesses on and off the reservation

- Talk to people who have had unsuccessful businesses

Self-Employment Shadow

As you explore self-employment, talk to your TVR counselor to see if they can help you find a business owner you could shadow for a day or two to get a better idea of what goes into running a business.

This can help you learn what life would be like as a business owner. It will give you and your TVR counselor useful information about the training and supports you might need to become self-employed.

Business Mentor

Once you start developing your business plan, it can be helpful to find a business mentor or someone who has experience running a similar business who can help you learn the ropes.

Talk to family, friends, your TVR counselor, or to a small business development center to help you find a mentor. Seek out previous TVR consumers who have successfully started businesses in your community for guidance, and ask about other local resources that might be available in your area.

Business Trial

Some TVR programs may provide opportunities to try out your business idea on a small scale. For instance, one TVR program assists with equipment rental to experiment with business production and initial sales.

Business Exploration Example: Emma’s Pizza Sales

Emma’s Business Idea

Emma loved hosting family birthday parties. She would volunteer to have pizza parties for her children, nieces, and nephews. Her guests and family loved her pizzas, and gave her outstanding compliments. She noticed that there weren’t any places near her community that sold pizza.

She decided she wanted to start a small business selling pizza, hot wings, salads and drinks. She went to the Tribal VR program to ask for assistance.

Emma’s Exploration

As part of exploring business feasibility, the TVR program supported Emma with an 8-week self-employment trial demonstration period. The trial period would allow Emma and the TVR counselor time to see if her business idea and desire to be self-employed would be successful.

Together, Emma and her TVR counselor figured out how many pizzas she would need to sell to cover her expenses and make a profit. The TVR program helped with minimal supplies to set Emma up so she could explore her business idea.

Emma’s Exploration Results

At the end of 6 weeks, Emma was struggling to show that she could run a successful pizza business because her disability was not allowing her the time needed to start the business. Her hours of operation were not steady, and sometimes her business was closed on days when her signs said she was open. She struggled to make enough pizzas to cover her costs, and over time she lost customers.

Emma’s Decision

After going over her profits and other business performance measures with her TVR counselor, Emma realized and accepted that right now was not the time to start her pizza business. She saw that she needed to take care of herself so that her disability would not flare up, and keep her from doing what she wanted to do. She also saw that the time needed to be successful and the amount of work to make a profit was not possible with her disability.

Although she really wanted to pursue self-employment, the trial demonstration period showed Emma that the pizza business was not a feasible option for her right now.

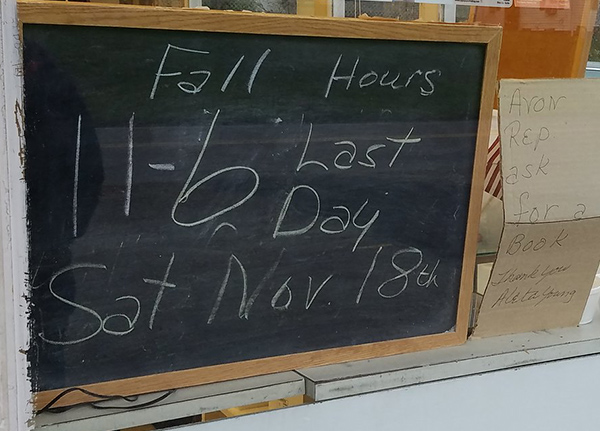

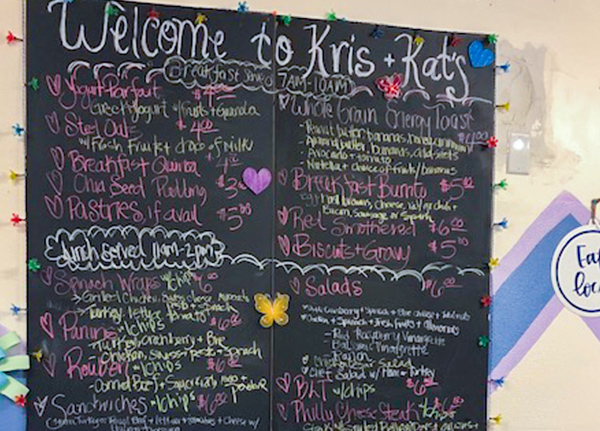

Business Exploration Example: Kris & Kat’s

Nadia’s Business Idea

Nadia lives in a rural community, and has always loved cooking and trying new healthy foods. She had some catering experience under her belt, and decided she would like to create a restaurant and catering business run out of her home.

She went to the TVR program with motivation and a plan of what she wanted to do.

Nadia’s Exploration

To help assess business feasibility, the TVR program supported Nadia with an 8-week self-employment trial demonstration period to see if her business idea and desire to be self-employed would be successful.

Nadia and her TVR counselor looked at financial projections and preliminary advertising, and started her 8-week demonstration period with minimal start up supplies.

Nadia’s Exploration Results

While Nadia was doing her trial demonstration, she also expressed interest in learning more about how to make her business successful.

Her TVR counselor connected her to the Small Business Development Center to help her with exploring and understanding what it takes to start a small business. She took weekend classes that helped her define her goals in how she was going to run her business.

Nadia was very patient with the TVR process, because she noticed that it can take a long time. She experienced some ups and downs with her business, but she never let that bring her down.

She worked harder and looked for ways to increase funding for her business so that she could get her restaurant up and going.

Nadia’s Decision

At the end of 8 weeks, Nadia was doing a great job and her sales were steady. She was even looking at hiring another person to help her run the business because she was starting to see demand from customers, especially for breakfast foods.

It was evident from her profit and the way she was running the demonstration period that Nadia could be successful in self-employment. It was at this point TVR decided to fully support her self-employment plan and move forward with additional purchases to make her restaurant and catering business successful.

Nadia closed her TVR case successfully, and a few months later she hired a student to assist her with running her business.

Use the "Return to Tabs" button below to jump to the tab navigation bar.

Then continue by selecting the next tab in the list.

Chapter Review

This chapter focused on business feasibility, or the chance your business will succeed. You thought about:

- Your business idea and the skills you need to operate your business

- Possible customers, similar businesses, and your business location

- Costs required to get your business up and running

- Potential challenges

All of this information is covered in more depth in later chapters. This chapter was meant to get you started in the process and to help you think about gaps you might need to address as you move forward.

Prepare

In this chapter, you explored the feasibility of your business idea. You used the About You, About Your Business, and Start-up Costs Estimates worksheets to help you think seriously about your business idea and your resources to do it.

- Do your best to fill out as much as you can in each worksheet.

-

If you are unsure how to answer a question or need more information, leave it blank.

- Make a list of questions and discuss these with your TVR counselor.

- Refer to later chapters in the website to learn more.

As you go through the rest of the chapters in this toolkit, add more detailed answers to the worksheets. Answers to these questions will help you complete a full business plan.

Click on the "TVR Counselor Review" button below for a short review of information for TVR counselors from this chapter.

Check Your Understanding

Assessing Business Feasibility

Read each of the three scenarios and consider if Lucy's, Len's, and David’s business ideas seem feasible. Use the content from this chapter to explain your decisions.

Write down your answers as you go through the scenarios and then check your answers. Remember, there are no “right or wrong” answers. Instead, think of ways Lucy, Len, and David might improve their business ideas.

Scenario 1: Lucy

Lucy’s Traditional Sewing

Lucy wants to start her own sewing business. Use the information below to explore if her business idea seems feasible.

- Lucy has been sewing for a long time and enjoys making traditional shirts for friends and family. Her community values locally made products and small local businesses.

- Lucy’s medical condition causes fatigue, so she wants to work from home so she can rest when she needs to. Lucy does not have a car and the bus stop is too far for her to walk, so her transportation options are limited.

- Lucy has been making traditional shirts for a while, but she wants to start making other items such as moccasins and quilts.

- She already sews in her spare time, but usually ends up donating what she makes to the community center.

- Most of the traditional clothing sold in her community are mass produced. She thinks she can offer a higher quality product from local materials.

- She does not have any bookkeeping experience, but her daughter has offered to teach her.

- Lucy calculated that she will need about $3,200 to start her business. She has some personal savings she can use to put towards her start-up costs.

Based on the information provided, decide if you think Lucy’s business idea seems feasible. Think about potential customers, other businesses, and her skills and interest. Do they set her up for success?

- First, write down the reasons why Lucy’s business could be successful.

- Next, write down the challenges that Lucy might face getting the business running.

- Then, think about solutions to these challenges and what might help make her business idea more feasible.

Click on "Lucy's Business Feasibility" to compare your answers.

Scenario 2: Len

Len’s Lawn Care

Len wants to start a lawncare business. Use the information below to explore if his business idea seems feasible.

- Len has a large property that he has maintained himself for nearly 10 years, and he enjoys working outside.

- Len has great customer skills and everyone in town knows who he is. He already does lots of outside chores for his friends and neighbors.

- He has some lawncare equipment, and knows how to maintain it himself. However, he would need to buy a trailer and repair his truck.

- During the winter, he can clear snow for his customers so he can maintain the business year-round.

- Len used to help his dad run his business and knows the basics of bookkeeping.

- Len has a bad knee that can make getting around difficult, but he has medication he can take when it flares up.

- Len lives in a community where there are many older adults who cannot maintain their own lawns. However, there are a few other lawncare and snow removal businesses nearby.

- Len calculated that he will need approximately $6,300 to start his business, but has some assets he can sell to put toward start-up costs.

Based on the information provided, decide if you think Len’s business idea seems feasible. Think about potential customers, other businesses, and his skills and interest. Do they set him up for success?

- First, write down the reasons why Len’s business idea could be successful.

- Next, write down the challenges that Len might face getting the business running.

- Then, think about solutions to these challenges and what might make his business idea feasible.

Click on "Len's Business Feasibility" to compare your answers.

Scenario 3: David

David’s Drums

David has been making traditional drums for a while but now wants to turn his skills and interest into a business.

- David is passionate about Indian culture and enjoys working with his hands. He has made drums as a hobby for several years and has created his own designs.

- David wants to be self-employed so he can rest when he needs to and go to counseling and support meetings.

- Several friends and family members have asked him about making drums and there are many local ceremonies and pow wows that use traditional drums in the area.

- There are no other drum makers on the reservation. When other people want to buy drums they usually have to order them from somewhere else.

- He can also offer drum-making lessons to promote his business and pass on traditional practices.

- David doesn’t have any bookkeeping experience, but the local college provides night classes.

- Since he will be working from his home, he will save money on business space.

- He calculated that he will need to make and sell approximately 8 drums per month.

- He will need about $7,000 to start his business.

Based on the information provided, decide if you think David’s business idea seems feasible. Think about potential customers, other businesses, and his skills and interest. Do they set him up for success?

- First, write down the reasons why David’s business idea could be successful.

- Next, write down the challenges that David might face getting the business running.

- Then, think about solutions to these challenges and what might make his business idea feasible.

Click on "David's Business Feasibility" to compare your answers.